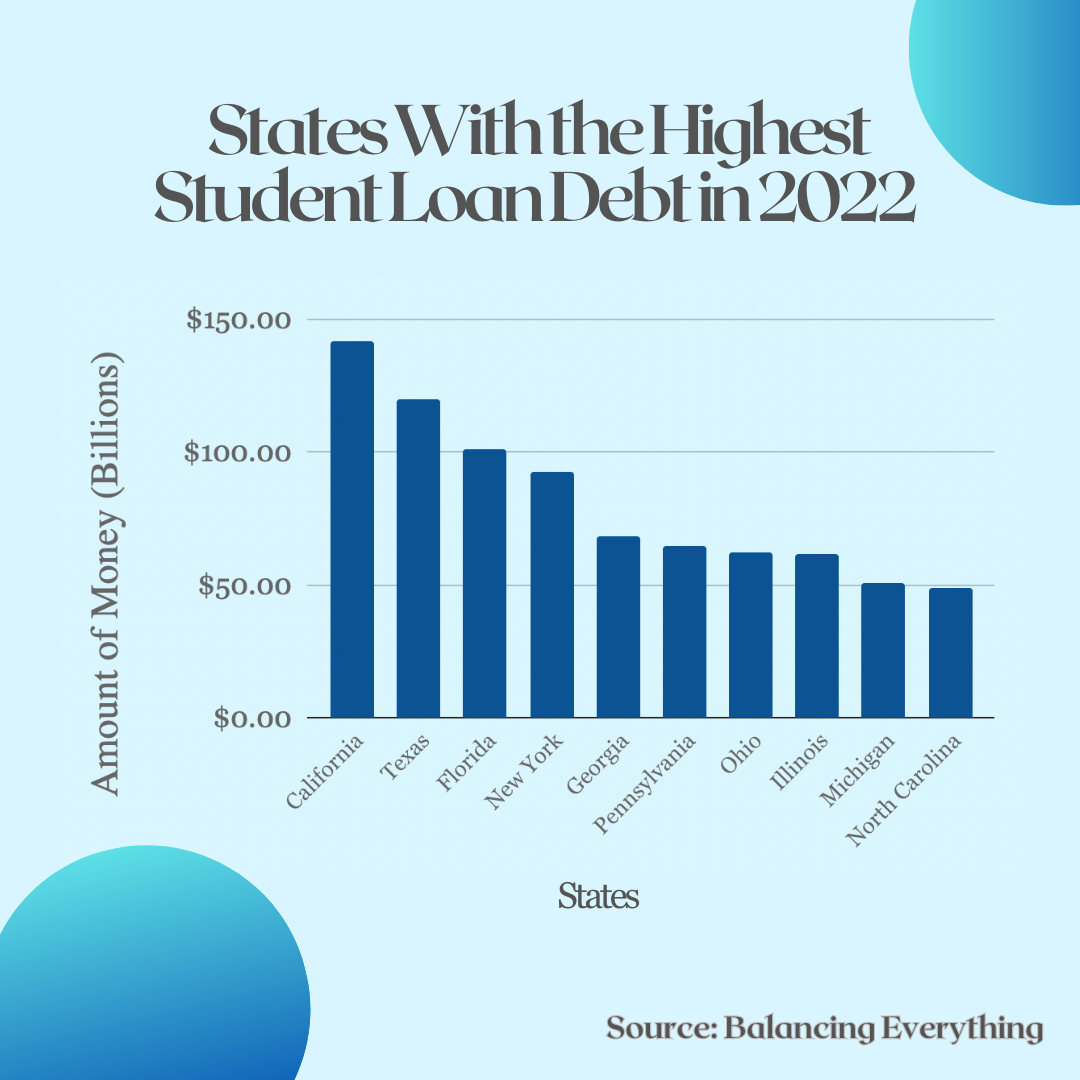

Student loan debt: A daunting statement that panics most Americans of all ages. Many believe that no matter how much money they make they will never be able to buy a home or retire because they are drowning in the debt they owe.

A big question in today’s American households is “is it worth it?” Many argue yes, given the fact 88 percent of billionaires received a bachelors and 52 percent earned a Ph.D. or Doctorate. A majority of careers require a college degree or credential to even be considered for a job position, And various economic-circles can’t even afford to receive an education.

Senior Angie Levano ’23, who will be attending Mount St. Mary’s University, has not taken out loans at the moment.

She did state, however, “If something were to happen in the future and I need student loans then I am afraid of the debt.”

In the beginning of President Joe Biden’s candidacy he promised Americans student loan debt forgiveness. Biden made that plan a reality by forgiving up to $20,000 of individual debt, totalling up to nearly $20 billion forgiven. The White House stated that 40 million Americans are eligible for the Biden relief plan, 26 million had already applied, and 16 million had been approved until the Federal Appeals Court blocked the program’s plan.

Although student loan debt forgiveness sounds relieving, many can make a compelling argument that it would not be a permanent solution. It could possibly be unfair causing student loan relief temporarily but then having a future generation pay for it later, which would double the amount paid in student loans and taxes.

Band teacher Lance Ohmneiss first attended junior college before later attending San Francisco State and then eventually finishing at Mosiah University, majoring in education and instrumental conducting.

When asked if he still owed student loans he answered, “Oh absolutely, I’ll owe student loans probably until the rest of my life.”

The process of debt repayment that most people deem unfair is not the obligation of paying off the expensive student loans, but how graduates don’t only pay what they borrowed but an added interest payment as well. Each check that goes into the plan is taken to pay the interest rate, not the loan. The interest increases the amount owed over time, causing most Americans to never escape their debt.

“I do believe if we were to do some sort of reform as a nation, it shouldn’t be that we should go ahead to expunge student loans, but pay loans interest free and pay off only what you borrowed,” said Ohmneiss.

College counselor Jackie Grealish recommends taking the community college route as an alternative for students who want to save money.

She also seems to be a big fan of trade school, saying, “Trade school is awesome because you start getting experience right away and generally make so much money.”