In late September, pop singer Shakira was convicted of six counts of tax fraud in the Spain.

Shakira Isabel Mabarak Ripoll is a famous Colombian Latin pop singer with countless hit singles. She started her music career at the age of 13 when she signed to Sony Music Colombia, and has been referred to as the “Queen of Latin Music.”

However, this famous latin singer has gotten into some trouble. Shakira owes the Spanish Government 14.5 million euros for not paying taxes between the years of 2012 and 2014. While she was on trial she claimed that she had paid all the money she owes back and more.

In the Times article Shakira states, “First of all, I didn’t spend 183 days per year at that time at all. I was busy fulfilling my professional commitments around the world.”

“Second, I’ve paid everything they claimed I owed, even before they filed a lawsuit,” she continued.

It is currently not confirmed if and when the trial will start.

“So as of today, I owe zero to them. And finally, I was advised by one of the four biggest tax specialist firms in the world, PricewaterhouseCoopers, so I was confident that I was doing things correctly and transparently from day one.”

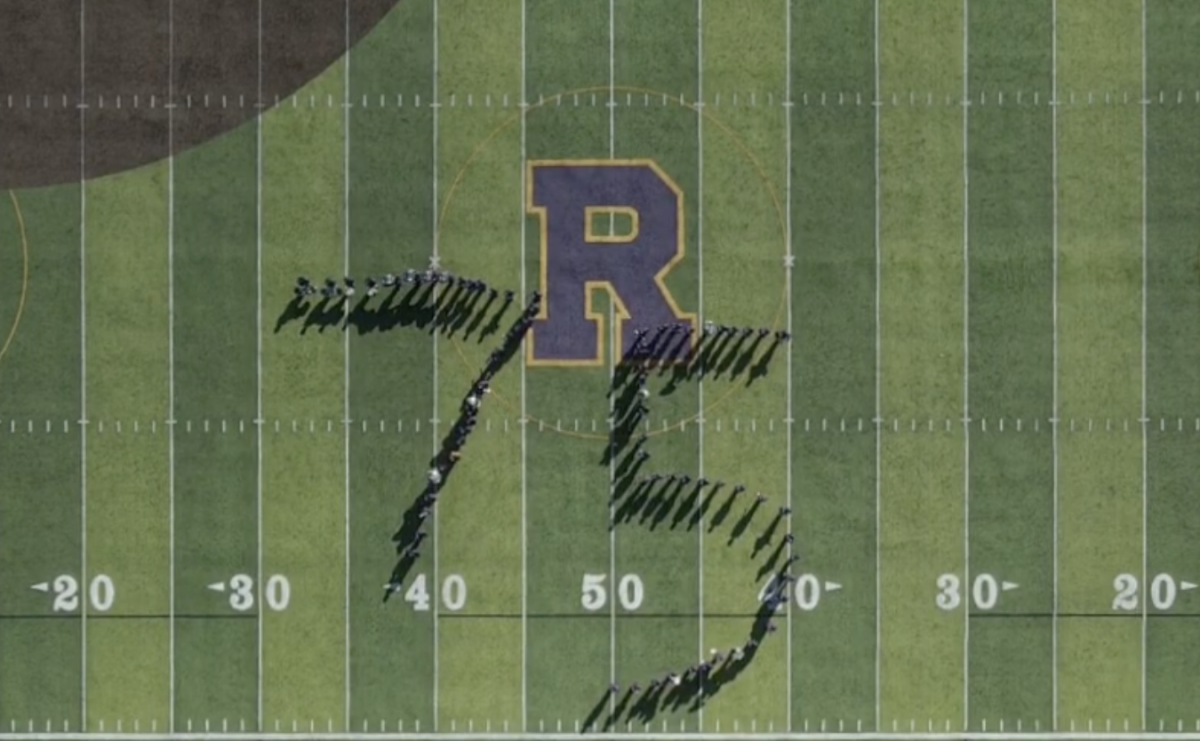

A few students from Riordan have given their opinion on the situation and have given their opinion on what should happen and ways we can fix the problem of tax fraud at a young age.

Gabrielle Glass ’24 said, “I think the Spanish Government is making the case a big deal because of her popularity level. And I believe this because the Spanish government has done this to other famous people such as Cristiano Ronaldo and Neymar.”

Niyah Spivey ’23 explained how she feels about the continuous pattern of famous people not paying their taxes saying, “I think that in a perfect world it would be nice if rich people would pay their ‘fair’ share of taxes but in reality people with lower incomes have to pay more and rich people can write off what they buy as a business expense so i’m not sure what to do.”

She later added, “[It’s] not what students can do, but what schools can do to teach students about how to pay taxes and learn about financial literacy so they don’t find themselves in that situation.”