San Francisco is notorious for its high taxes. With the recent exodus of downtown’s companies as well as a reputation on crime nationwide, city leaders are looking for ways to incentivize businesses to remain in SF.

The iconic sign of Beep’s Burgers is a siren call to hungry Crusaders every day after school. Beep’s has managed to remain a competitive cult favorite despite a McDonald’s just down the block.

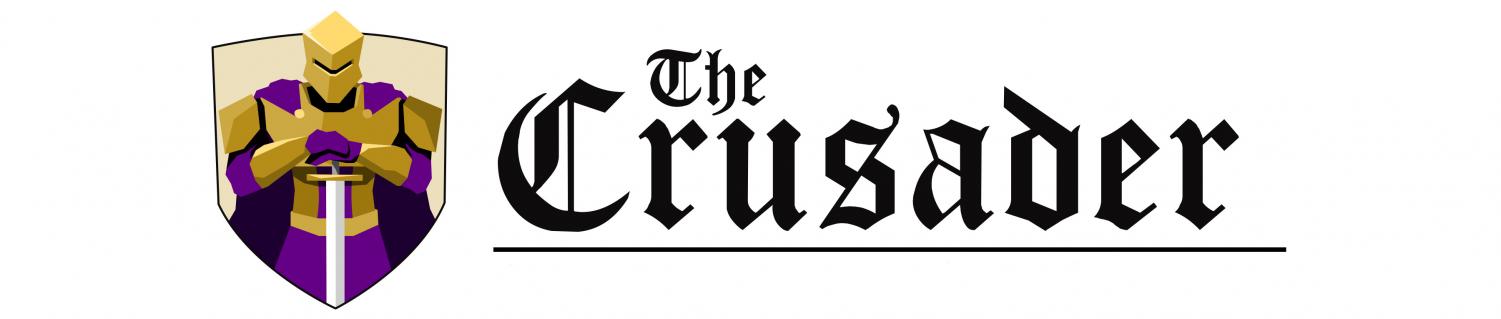

Enter Prop M, a business tax cut that will affect 91 percent of restaurants and 97 percent of bars and nightclubs. It’s a measure that has gained rare, across-the-board support in SF’s famously divisive politics, drawing endorsements from progressives, moderates, business owners, and politicians city-wise. It passed overwhelmingly by 69.51 percent to 30.49 percent.

Brian Davis, who teaches the Business track program at Riordan, said, “Small businesses typically fail within the first year. Lowering the tax burden will enable small businesses to be more competitive with larger businesses.”

Prop M aims to enact a complete overhaul of the city’s business tax system. The state of San Francisco’s post-pandemic recovery has spurred the momentum behind the measure as well as concern behind the sustainability of the city government’s current business tax system.

Along with exempting more small businesses from taxes and fees–eliminating gross receipts taxes for 2,700 small businesses–it also reduces taxes for some of SF’s biggest companies in an effort to get them to stay.

According to a city report, only the five largest companies pay around a quarter of all business taxes. Should a single one of those companies leave, it will have significant repercussions on SF’s tax revenue–and thus ability to fund vital public services.

A worker packages dumplings at Chase Lucky Bakery on Ocean Ave., an establishment that will likely be impacted by Prop M.

Davis continued, “It will help consumers–’everyday San Franciscans’–via lower prices as taxes are ultimately paid for by consumers via higher pricing. If a business is unable to pass along the taxes they may be forced to close.”

However, Prop M would also raise taxes on mid-size businesses that make large revenue and have a small number of staff. Industries likely to see their gross receipts taxes (applied to a business’s total revenue from sales) increase included biotechnology (18 percent increase), retail (16 percent), and construction (7 percent) in order to supplement the loss in revenue from corresponding tax cuts.

Now that Prop M has passed, it’s expected to initially lose money for the city for three years, by $40 million annually. It intends to recoup costs with scheduled rate increases that earn $50 million per year, thus offsetting the loss in time for the 2029-2030 Fiscal year.

Scan the QR code or click the link for an interactive chart about San Francisco’s sales tax. https://public.flourish.studio/visualisation/20729651/

Davis commented, “The city also needs to reduce spending to offset potential tax revenue decreases.”

The measure further benefits most businesses by consolidating the city’s 14 business categories into seven, making it easier for businesses to pay their taxes. It also aims to incentivize workers to come back to office, with the specific goal of revitalizing downtown, with proponents citing how the continued trend of remote work has been partially responsible for downtown’s decline.

The primary opposition comes from Larry Marso, a local tech executive and attorney. Marso, a Republican, argues that Prop M tries to generate more revenue through steep tax hikes that primarily affect larger to midsize companies. However, opposition was largely limited; no formal campaign has reported fundraising activity in opposition to the measure.