Due to the outbreak of COVID-19, President Donald Trump signed a bipartisan $2 trillion economic relief plan to offer assistance to tens of millions of American households affected by the coronavirus pandemic.

The point of the stimulus package is to try to keep the country from a recession.

AP Government teacher David Elu said, “Since the economy is slow right now and nobody is spending money that will cause our GDP to drop.”

If not for the stimulus package people would not be spending any money which would then put the country in a deeper recession than it currently is.

According to Elu, a “recession according to most economists is when the country’s GDP drops for two consecutive quarters. A quarter in the economy is three months.”

He added, “There is a likelihood that another stimulus package coming out after shelter in place is lifted.”

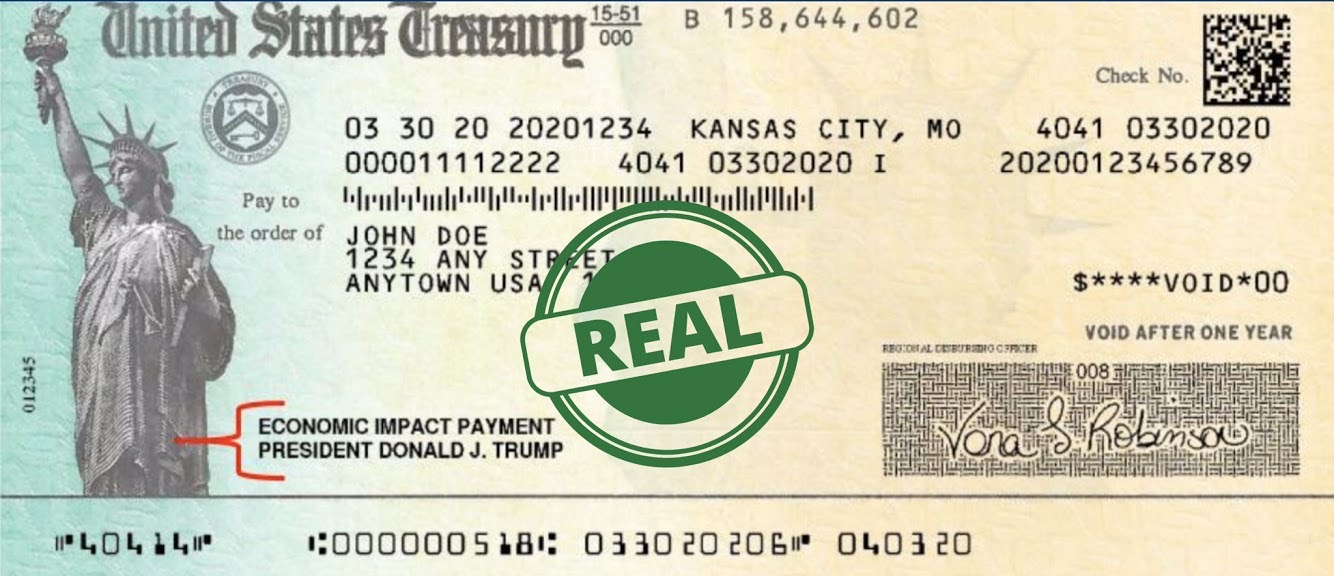

The basic breakdown of each persons’ stimulus package is $1,200, but some people will receive less, or nothing at all. For every child 16 and under, citizens will receive an additional $500.

To see when the check will arrive, people can go to the IRS website. The amount of money each person receives depends on income.

Single adults with Social Security numbers who have an adjusted gross income of $75,000 or less will get the full amount. Married couples with no children earning $150,000 or less will receive a total of $2,400. And taxpayers filing as head of household will get the full payment if they earned $112,500 or less.

Above those income figures, the payment decreases until it stops altogether for single people earning $99,000 or married people who have no children and earn $198,000. According to the Senate Finance Committee, a family with two children will no longer be eligible for any payments if its income surpassed $218,000.

No one can get a payment if someone claims them as a dependent, even if they are an adult.

In any given family and in most instances, everyone must have a valid Social Security number in order to be eligible. There is an exception for members of the military.

Those unsure as to what their refund will be can find their adjusted gross income on Line 8b of the 2019 federal tax return. Those who haven’t prepared a tax return yet, can use the 2018 tax return.

If the IRS already has someone’s bank account information, they will send the money directly to the account based on the recent income-tax figure they already have.

The payment started showing up in bank accounts last month. Treasury Secretary Steven Mnuchin said that most people will receive their payment by April 17. Those waiting for a paper check will have to wait longer because the federal government is producing and distributing them in batches.

The U.S. Department of the Treasury also warned people via their Twitter account to be on guard for fake checks and scams.